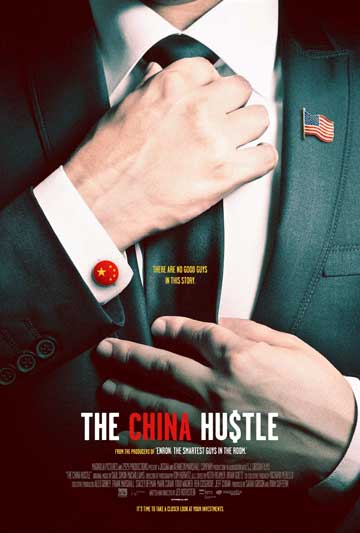

Film (2018)

Documentary

Directed by Jed Rothstein

Kendall Square Cinema

Cambridge, MA

Beginning with testaments from a train of recent US presidents, starting with Richard Nixon, about the possibilities of opening greater commerce with China, this provocative film transitions elegantly to a scene at the iconic brass bull on Wall Street at which people from around the world are paying homage.

The question What is Capitalism? is put forth bluntly before the odd hero-anti-hero of the film, Dan David, appears to speak of one its recent less than noble mutations. As the CIO of F.G. Alpha Management, a hedge fund firm that was responsible for whipping up illusions of profitable investments in Chinese businesses in the wake of the real estate crash of 2008, David is in a position to speak authoritatively from the inside, which he does. There are no good guys in this story, including me, says this insider turned whistle-blower, with amusing alarm.

With charged humor of this sort and a no-pulled-punches approach similar to such recent groundbreaking finance-revelation documentaries as Alex Gibney’s Enron: The Smartest Guys in the Room (2005) and Charles Ferguson’s Inside Job (2010), The China Hustle bears its unsettling message with wry criticality. (Gibney is, in fact, an executive producer of The China Hustle). At one fell swoop revelatory, deeply unsettling, and oddly entertaining, it bears its revelations of yet new ways in which innovators of dubious financial instruments began to operate before the ink was dry on the market obituaries of 2008.

The inventiveness of the methods for enabling investments in misrepresented and overblown Chinese businessess and the lunacy of the sales pitches surrounding these is startling. Scenes echoing those in Martin Scorsese’s wildly Rabelaisian The Wolf of Wall Street (2013) abound, with unhinged promotional events for newly wrappered Chinese stocks offered by these unabashed gold-rush merchants. One of these, Byron Roth, CEO of Roth Partners, is featured swimming unrestrained atop a sea of arms in a mosh pit celebration for one of these over-the-top sales events.

in “The China Hustle”

Image: Courtesy of Magnolia Pictures

The inventiveness of the method for enabling such investments becomes all too apparent. Because of legal restrictions on Americans investing directly in Chinese businesses, the method of wrappering them within the shells of defunct American businesses in which one could buy stock as so-called reverse mergers became a standardized vehicle for opening the Chinese business market to Americans.

Unfortunately, despite all the indications that the Chinese business landscape was booming, many of these “wrappered” Chinese businesses were junk investments adorned with glitter. Amid the hype and the backwaters of shock from the 2008 crash, nobody seemed to pay too much attention to that possibility. As Dan David indicates, much like the packaged real estate investments that led to the events of 2008, these Chinese investments were garbage packaged as gold.

General Wesley Clark, as seemingly a pristine straight-arrow as one could possibly find, winds up, in the wake of his attenuated presidential bids in 2004 and 2008, as the CEO of Rodman & Renshaw, one of the other firms that took a leading role in this Chinese investment come-on. Clark is pictured not as an architect of the scheme but as a figurehead dupe, a noble face hired to appear on the cover of the book, the contents of which are far less scrupulous than they might seem.

The most shocking aspect of all of this is that this method of introducing poor Chinese investments through defunct but listed American companies is perfectly legal within American contexts. Though seductively misleading to its potential army of American investors, the maneuver does not break the law.

Nevertheless, riding right on the edge of misrepresentation, the technique resembles the sorts of manipulation that were putatively legal running up to the crisis of 2008, but which showed, in the wake of the crash, many of the indications of duping and bad faith that go along with serious infractions.

A good part of the ensuing story after 2008 was that, after bailing out some of the financial perpetrators, a Republican dominated Congress, and now the new Republican administration, resistant to imposing constraints on the endless possibilities for financial machinations in the guise of straight business, has not found its way to enabling the full force of legislation like Dodd-Frank, or allowing the Consumer Protection Agency to do their proper work. All of this enables continuing schemes like that depicted in The China Hustle

Fascinating, raw, hilarious and scary, The China Hustle offers enough sober criticism of yet another way in which financially inventive operators, skating right on the edge of the unscrupulous, do their work unconstrained, while the inevitable calamitous consequences, so familiar and regular, lurk in the wings.

– BADMan

Leave a Reply